Investing activities – This section shows the amount of cash firms spend on investments.It includes receipts from the sale of goods or services, receipts for the sale of loans, debt or equity instruments in a trading portfolio, interest received on loans, payments to suppliers for goods and services, payments to employees, etc. This section comes first and tells you how much cash the company generated from its core business, as opposed to peripheral activities such as investing or borrowing. Operating activities – converts the items reported on the income statement from the accrual basis of accounting to cash.The cash flow statement organizes and reports the cash generated and used in the following categories:

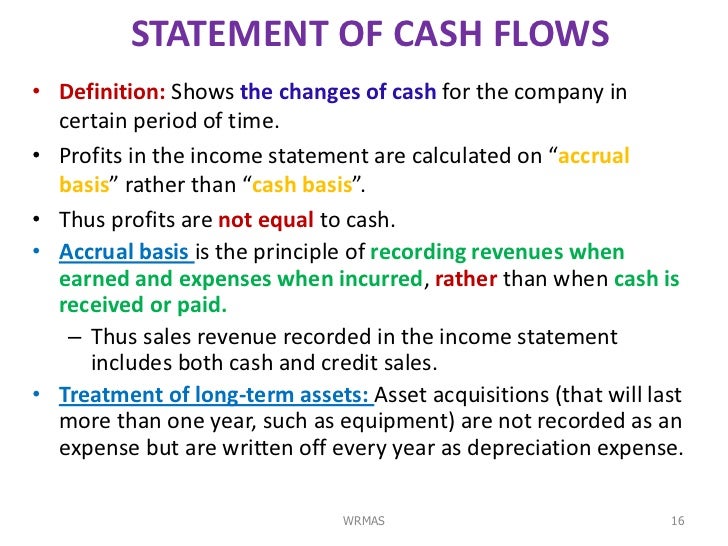

Many companies have shown profits on the income statement but have stumbled later because of insufficient cash flows.Ĭompanies can generate cash in several different ways. The statement of cash flows strips out all the abstract, noncash revenues, and expenses that are included in the income statement. It is useful in determining the short-term viability of a company, particularly its ability to pay bills. It shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities.Īs an analytical tool, the statement of cash flows is an indicator of a company’s financial strength. In other words, it shows how much cash a company is generating from one period to the next. The purpose of the cash flow statement is to report how much cash went into and out of a company during a specific time frame like a quarter or a year. All three statements are prepared from the same accounting data, but each statement serves its own purpose. The balance sheet, income statement, and cash flow statement are the three generally accepted financial statements used by most businesses for financial reporting.

0 kommentar(er)

0 kommentar(er)